Automated Trading

Automated trading. access ig's execution and pricing as you implement your own forex trading strategies. forex trading involves risk. losses can exceed deposits. fit your strategy around your schedule execute trades automatically, day or night. Automated trading platforms. automated trading platforms enable traders to mirror or copy the trades of others. a trader can copy signals or automated trading mirror complete strategies, thus enjoying the experience and knowledge of successful traders.

Automated trading systems: the pros and cons.

Basics Of Algorithmic Trading Concepts And Examples

Automated Trading Systems The Pros And Cons

Automated trading systems blue wave trading.

Automated trading systems don’t have an opinion and don’t have emotions they stick to a programmed set of rules no matter what is happening around them, providing the discipline and patience required for a more objective and reliable approach to trading. Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of instructions (an algorithm) to place a trade. Automated trading software goes by a few different names, such as expert advisors (eas), robotic trading, program trading, automated trading or black box trading. automated software is a program that runs on a computer and trades for the person running the program.

Automated trading (also known as copy trading, bot trading, black box trading, robotic trading, or algorithmic trading) is the most advanced field among forex traders. it is done by using a software written according to a predefined strategy and it is a major solution automated trading for replacing the merchant's job. Some advanced automated day trading software will even monitor the news to help make your trades. strengths & weaknesses strengths. reduces emotion one of the biggest benefits of automated day trading algorithms is their ability to remove human emotion. many day traders will buy and sell based on feelings, automated day trading systems will. Trade futures, forex & stocks through a superdom, chart trader or using automated trading to protect your positions with automatic stop & target orders.

Automated Trading Software The Top 4 Reliable Auto

Offers 5 forex trading systems for automated trading with live results every 30 minutes. A simple explanation of what stock, options or futures automated trading involves would be that it is a computer program that is able to create orders. it then submits these automatically to a market or exchange center. you can set your specifications and rules, and allow the program to monitor the market in order to find opportunities to buy and sell according to these specifications. What is an algorithmic or automated trading system? from wikipedia, the free encyclopedia. algorithmic trading, also called automated trading, black-box trading, or algo trading, is the use of electronic platforms for entering trading orders with an algorithm which executes pre-programmed trading instructions accounting for a variety of variables such as timing, price, and volume. What is automated trading software? automated trading software is a sophisticated trading platform that uses computer algorithms to monitor markets for certain conditions. a stock market trader.

The auto trading forex robots can also scour a range of markets for trading opportunities and monitor a number of different trades. in order to create a realistic picture of automated trading systems it’s time to look at some of the automated trading downfalls you should be aware of: disadvantages of automated forex trading. If you are looking for the best possible automated trading experience, then pepperstone is the broker for you. widely regarded as the best forex broker in australia, pepperstone is also a solid all-rounder with plenty of other excellent features to win over traders, including the choice of either ecn or stp accounts and the option to trade with ctrader web.

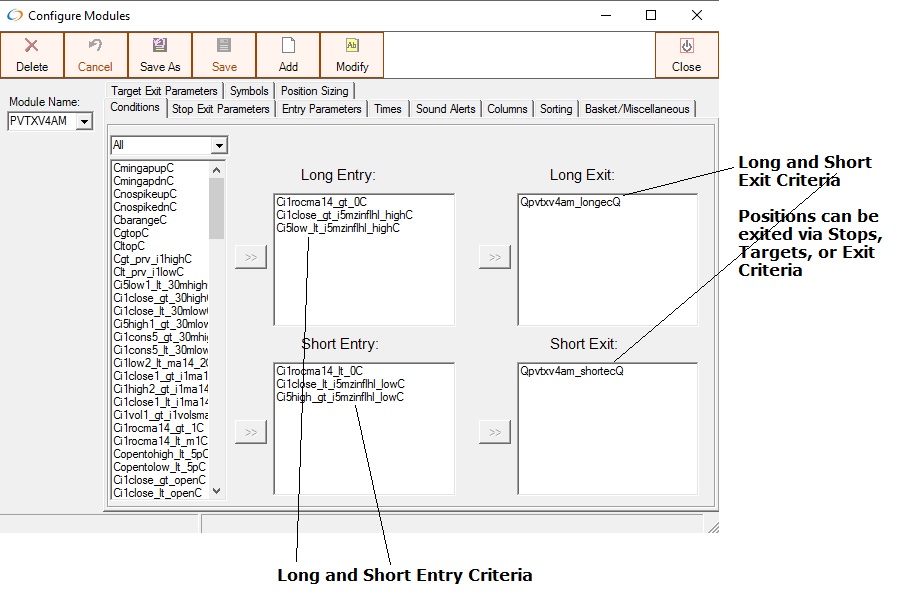

See more videos for automated trading. Automated trading systems — also referred to as mechanical trading systems, algorithmic trading, automated trading or system trading — allow automated trading traders to establish specific rules for both trade.

The pros of automated trading and automated systems. forex trading is considered as one of the premiere markets to trade, and an automated forex trading system can help by instantly executing all forex transactions. with the help of this software, the trader will only have to switch on the computer and let the software take care of placing. The industry’s top automated trading system. automated means it runs automatically, without the need for you to be glued to the computer so as to not miss any trade setups or exit points. the trading strategies are programmed to react to price movements and place orders to enter and exit as needed.

The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. the theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option. For the automated trading 16 th episode of “how to thinkscript”, we’ll switch gears and explore writing thinkscript code to achieve as close to automated trading in thinkorswim, as we can.. now, before i move further, i want to caveat by saying that this technique still requires you to manually write code, every time you’d like the condition to trigger you either into or out of a trade. Trade account management through specialized metatrader 5 applications is called automated trading or algorithmic trading. these applications are referred to as trading robots; they can analyze quotes of financial instruments, as well as execute trade operations on the forex and exchange markets. trading robots can perform operations on financial markets and as a result, a trader can be.

Belum ada Komentar untuk "Automated Trading"

Posting Komentar