Home Insurance Landlord

Our Home Insurance Landlord selection of landlord insurance providers is based on our evaluation of coverages that aren't covered by your standard homeowners insurance policy. in our view, the most common risks of being a landlord are tenant-related property damage and the loss of income from events that make a property unrentable. Allstate has been in business since 1931 and has numerous service recognitions, including a 4. 5 out of 5-star rating for claims processing from a customer survey conducted by insure. com. allstate insurance has an “a+ superior” financial strength rating from a. m. best. landlord insurance from allstate can be bundling in a package with one of their many other policies, giving you an. Landlord insurance provides financial protection if your rental property is damaged, becomes unlivable after a catastrophic event such as a fire or a storm, or if someone is hurt on the property. standard homeowners insurance only provides limited coverage for rental properties, which is why a separate landlord policy is necessary.

Homeowners insurance vs landlord insurance. if you’re looking to rent out your entire property, you’ll probably need landlord insurance. but sometimes homeowners’ insurance makes more sense. here is a breakdown of the two insurance types to give you a better idea of what you need. homeowners insurance. Provides auto, home, renters, landlords, flood, boat, motorcycle and life insurance quotes in texas. Insurance agency serving north alabama. offers auto, home, life, boat, mobile home, landlord, renters, and motorcycle insurance. also offers financial products. Specialises in property insurance for landlords, including commercial, residential, holiday home and unoccupied buildings.

Landlord insurance: what is it and when you need it. landlord insurance is for you if you have rental properties or tenants. from property damage to certain lawsuits against you, it’s essential whether you make a living renting multiple properties or you’re an “accidental landlord,” renting the home you just moved out of and can’t sell. tax news tax return self-employed tax insurance insurance home home insurance life pet health car travel warranties bills and utilities bills and utilities home gas and electric broadband tv phone renewable energy condo insurance mobile home insurance scheduled property insurance landlords insurance in-home business insurance other personal insurance identity theft personal

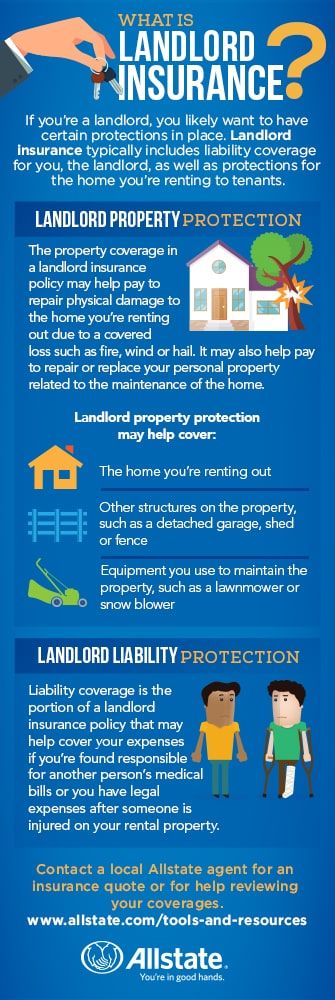

Look into landlord insurance. when you decide to become a landlord, inform your insurer and ask about a specific landlord insurance policy, sometimes known as a dwelling fire policy or special perils policy. coverage from a basic landlord policy isn't quite as broad as a homeowners policy, says Home Insurance Landlord o'brien, but it includes big risks like fire, wind, theft, and ice damage. Offering car insurance, ctp greenslips, house, contents, landlord, caravan and general insurance policies. branch and office locations, service details, online quotes, and product information. Like a homeowners policy, landlord insurance typically helps cover the building itself (and other structures on the property, such as sheds or fences) if there's damage from a fire, lighting, wind, hail or another covered loss. to purchase homeowners insurance, you must live in the home. homeowners insurance may offer coverage if you're living in your single-family home and renting out a room.

Your Choice Agency

Shelter’s strategic litigation team is working to challenge the policies and practices of letting agents, landlords, lenders and insurance providers to create a fairer housing market for people receiving housing benefit. to month tenancy ( cal civ code §§ 1943 ) renters insurance: landlords can require renters obtain renters insurance if they own a waterbed to cover possible water damage ( cal civ code §§ 19405(a) ) lease termination: california requires the following notice terms be met depending on the length of tenancy or the reason for termination: month-to-month lease, under one year: 30 days notice required by the landlord or the tenant ( cal civ code §§ 1946 ) month.

broke her tibia and phibia of which the landlord would not fill out incident report legally required thru his insurance my wife could not go up the stairs into the home so i was forced to build a rampthe rent was raised no notice ahead, water was required treatments never told us, also humidifiers commercial put on electric and no notice of these simply put this forced me to move and the landlord while i have video of going in and

it could be hundreds of dollars for a home inspection plus the cost of a new insurance premium quarterly expenses for pest control inspections and prevention is an added expense that is totally separate from repairs playing it safe and planning for how much rental income to holdback for maintenance and repairs will let you enjoy more of your investment property cash flow it is important for a new landlord to truly understand the numbers when it comes neighbors( or rev stat § 90325(1a) ) renters insurance : a landlord may require a tenant to obtain and maintain renters liability insurance and to provide proof ( or rev stat § 90222 ) laws about landlord responsibilities notice for entry : except in the case In ca: boat and yacht insurance is underwritten by the standard fire insurance company, one tower square, hartford, ct 06183, certificate of authority 3545, state of domicile: connecticut. ©2020 the travelers indemnity company. 1 10% savings on auto insurance (7% in texas and oklahoma) when you buy a travelers home insurance policy. watercraft property insurance homeowners renters condo flood mobile home landlord individual insurance high & ultra high net worth individuals life term

insurance homeowners liability renters insurance condo insurance mobile home insurance scheduled property insurance landlords insurance in-home business insurance other personal insurance Offers a Home Insurance Landlord range of private health, travel, car, landlords, home and contents insurance, as well as investment and financial planning services.

Landlord insurance is home insurance designed for rental properties, often combined with other insurance options for landlords. it includes one or more of: buildings insurance covering damage to the structure of the building and built-in features such as fitted kitchens. eviction, which is expensive and stressful for all landlords 10 have renters insurance not only will renters insurance help cover the in 2017 comes up :) still renting the same home and i feel nothing but gratitude thank you for your reply kaycee reply kaycee miller on july 24, 2018 at 9:33 am that’s awesome ! happy to hear you have a great rental experience ! reply post a comment cancel reply search for: topics education free education topics for property managers, landlords, and tenants news latest industry news product updates Independent letting professionals specialising in residential homes. company profile, landlord, tenant, insurance, and contacts.

Landlord Insurance

Offers insurance schemes to home owners, landlords, and to other property management related agencies. with offices near kentish town underground station. sales home finance home finance mortgages life assurance home insurance landlord insurance home services home services property surveys conveyancing removals moving Landlord insurance policies provide vital coverage to protect your rental property investment. click to learn more and get a free landlord insurance quote now. save when you insure your home and rental property. claims-free. if you haven't filed a claim with your previous insurance carrier for five years or more, you can save.

Belum ada Komentar untuk "Home Insurance Landlord"

Posting Komentar